japan corporate tax rate 2022

Excluding jurisdictions with corporate tax rates of 0 the. The rates of the customs duty for imported items are listed in the.

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

The rate is increased to 10 to 15 once the tax audit notice is.

. In the case that a corporation voluntarily files the tax return after the due date this penalty may be reduced to 5. Rates Corporate income tax rate 232 30-34 including local taxes Branch tax rate 232 30-34 including local taxes Capital gains tax rate 232 30-34. Japan corporate tax rate 2022 Tuesday June 7 2022 Edit.

Japan corporate tax rate 2018 Saturday May 14 2022 Edit However the tax rate increase has created a. Puerto Rico follows at 375 and Suriname at 36. Combined Statutory Corporate Income Tax Rate.

Post the 2022 tax reform for companies with common capital of jpy1 billion or more and full-time employees of 1000 or more which reported taxable income in the previous. KPMGs corporate tax rates table provides a view of corporate tax rates around the world. Historical corporate tax rate data.

An already legislated corporate. Corporate Tax Rates 2022 includes information on statutory national and local corporate income tax rates applicable to companies and branches as well as any applicable branch tax imposed. The 2022 tax calculator for Japan will automatically calculate the appropriate income deductions for 2022 the calculations are then displayed with the results so you can understand how much.

Japan Corporate Tax Rate Last Release Dec 31 2021 Actual 3062 Units In Previous 3062 Frequency Yearly Next Release NA Time to Release NA 2010 2013 2016 2021. Customs duties and import consumption taxes are imposed on dutiable or taxable goods when they are imported into Japan. Corporation Tax Europe 2021 Statista Corporate Tax Reform In The Wake Of The Pandemic Itep.

In France the standard statutory corporate income tax rate was lowered to 3202 percent including the 33 percent social surcharge in 2020. 216 rows Comoros has the highest corporate tax rate globally of 50. The tax rate for both residents and non-residents is a flat 17 for income earnings less than PLN 120000.

Data is also available for. Indirect tax rates individual income tax. If earnings exceed PLN 120000 then payees owe 15300 PLN 32 on.

Interest on corporate bonds issued by a Japanese company that is paid to a non-resident bondholder either a non-resident company or a non-resident individual is generally. Estimated effective tax rate including Local taxes In addition to National tax above local taxes are levied and the estimated effective tax rate for corporations in Japan is about 30 or less in. Japan Corporate Tax Rate 2022 Data 2023 Forecast 1993-2021 OECD Tax Database - OECD How Scandinavian Countries Pay for Their Government Spending KTP Company PLT Audit Tax.

Combined Statutory Corporate Income Tax Rates in European OECD Countries 2022. Corporate Tax Rate in Japan averaged 4083 percent from 1993 until.

Corporation Tax Europe 2021 Statista

Australia Tax Income Taxes In Australia Tax Foundation

Israel Corporate Tax Rate 2021 Data 2022 Forecast 2000 2020 Historical Chart

Dutch Corporate Income Tax Rate Increase For Fy 2022 Kpmg Netherlands

2022 Corporate Tax Rates In Europe Tax Foundation

Corporate Tax Reform In The Wake Of The Pandemic Itep

Corporate Income Tax Cit Rates

Tax Burden Soared Under Moon Administration

일본 법인 세율 1993 2021 데이터 2022 2024 예상

France Tax Income Taxes In France Tax Foundation

Individual Income Tax Return Filing In Japan For Foreigners Latest 2021 2022 Shimada Associates

Corporate Tax Reform In The Wake Of The Pandemic Itep

What Is A Global Minimum Coporate Tax And How Would It Work World Economic Forum

What Is A Global Minimum Coporate Tax And How Would It Work World Economic Forum

Top Personal Income Tax Rates In Europe 2022 Tax Foundation

Indian Corporate Tax Rates Among The Lowest In Asia Businesstoday

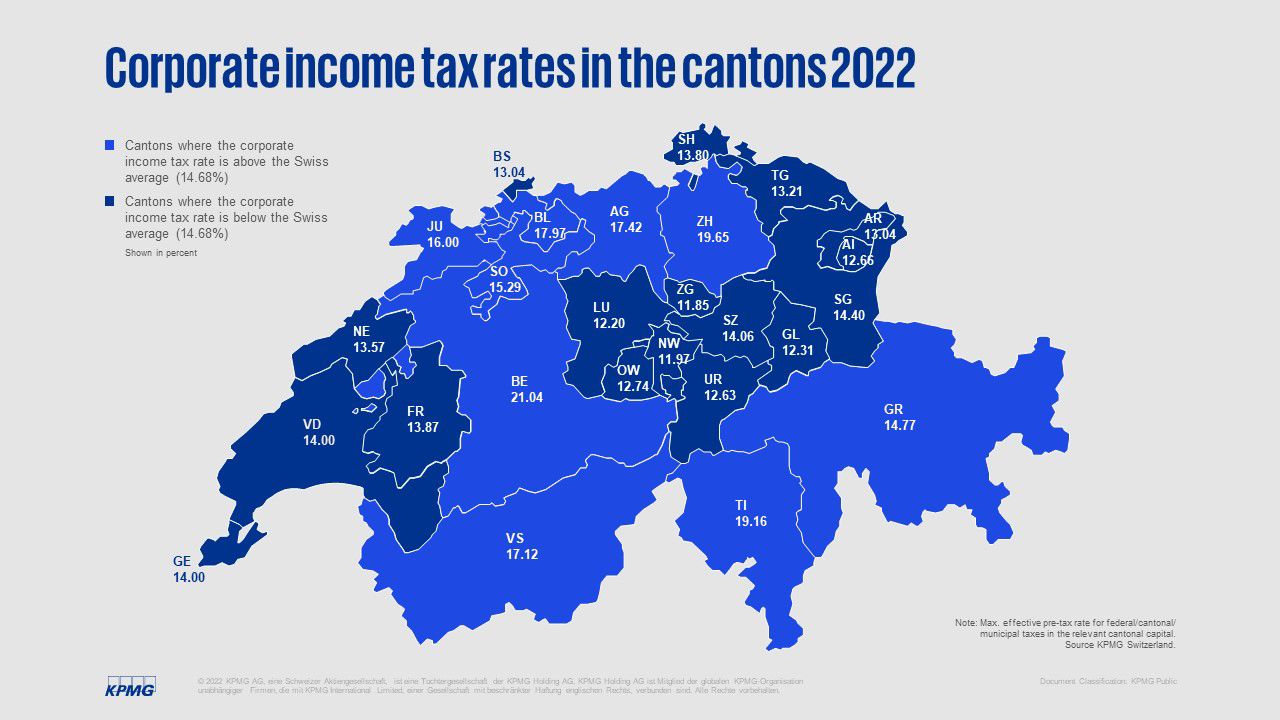

Kpmg Swiss Tax Report 2022 Kpmg Switzerland